Table of Contents

U.S. demand for engineered lumber is forecast to climb 1.6% annually through 2025 to 2.5 billion bd. ft. valued at $2.2 billion, according to a new Freedonia Group study.

The largest market gains in both value and volume terms will be recorded by laminated veneer lumber (LVL), bolstered by demand increases in the South, which accounted for 50% of the LVL sales total in 2020.

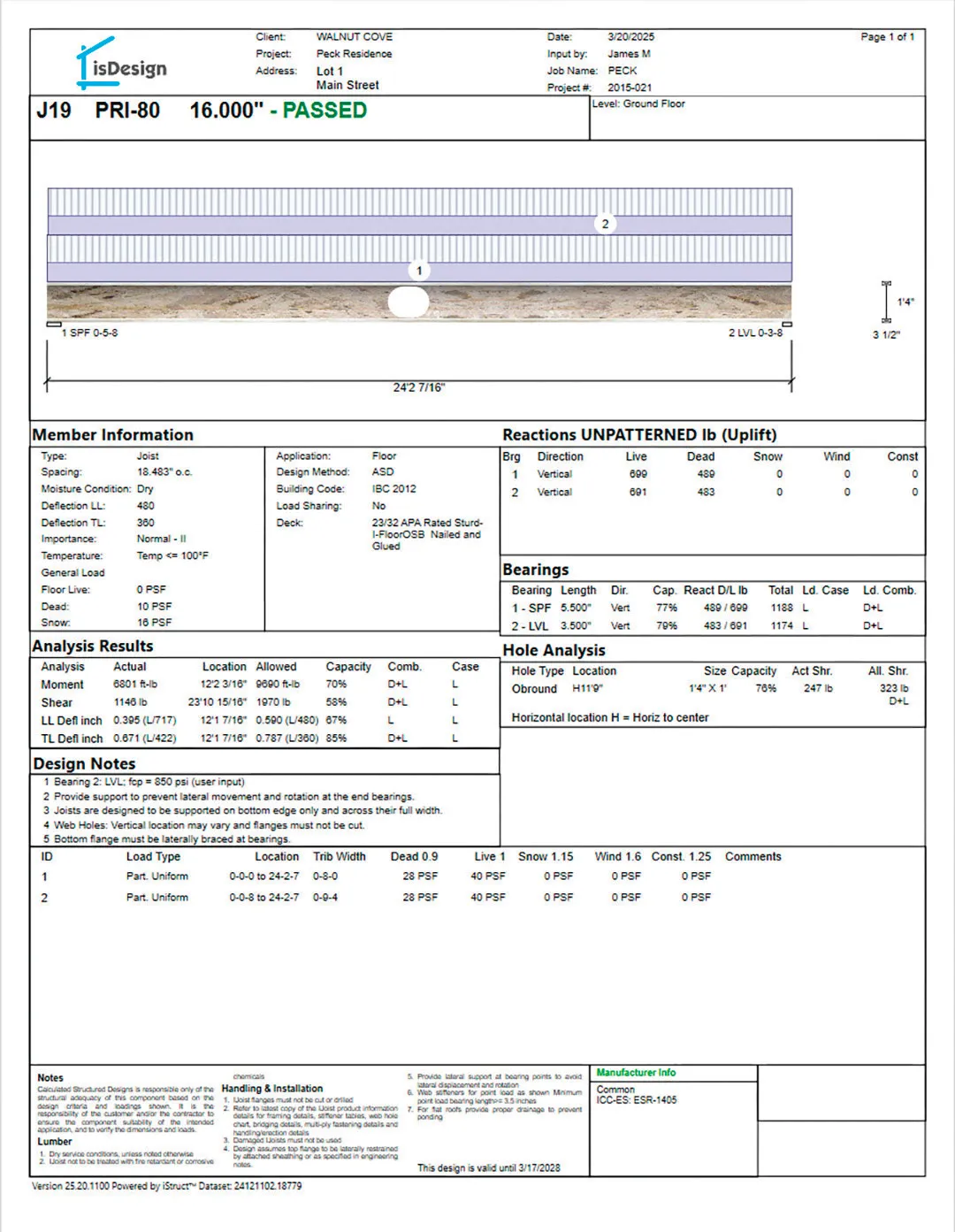

I-joists will remain the most commonly used type of EWP in 2025 in volume terms, primarily due to their relatively low cost and superior structural strength, which allows them to support heavy loads with less lumber than solid wood joists.

Structural and framing applications—such as floors, foundations, roofing and walls—will continue to account for the majority of EWP demand through 2025. Engineered lumber suppliers will benefit from favorable outlooks for new home additions and commercial construction, but overall sales growth through 2025 will be negatively affected by a decline in new housing activity following a 2021 cyclical peak.

Structural floors and foundations will register the largest increases in volume terms, boosted by the intensive use of I-joists and LVL in floor joists and other flooring supports.

Wall supports will record the fastest advances, as builders looking to create more durable wall sections will opt for trusses and supports that incorporate engineered lumber.